I'm considering buying an ounce of gold or an amount of silver that would equal the cost of an ounce of gold. I'm not sure which to go with. At this point in time, is one more than slightly better than the other?

basketweave

Silver or Gold right now?

basketweave

Discussion starter

970 posts

·

Joined 2011

- Add to quote Only show this user

I'm considering buying an ounce of gold or an amount of silver that would equal the cost of an ounce of gold. I'm not sure which to go with. At this point in time, is one more than slightly better than the other?

1,515 posts

·

Joined 2013

It might depend on your purpose for buying it. Currency or investment?

basketweave

Discussion starter

970 posts

·

Joined 2011

To switch some dollars in the bank to precious metals in order to protect funds from inflation. I guess both currency and investment. Probably more investment than currency, though.

4,040 posts

·

Joined 2012

I always suggest people start with silver. It has a lot more room to grow at it's current point and is also relatively low right now. Silver is excellent barter material. Gold is awesome, but I feel it should come once you are well set on silver. I had been stacking silver up for over 8 years, before buying gold. Just my take.

2,029 posts

·

Joined 2021

The spot price is relatively low. The problem is it costs like 40% more than spot to buy it.I always suggest people start with silver. It has a lot more room to grow at it's current point and is also relatively low right now.

4,430 posts

·

Joined 2013

You can take what I say with a grain of salt.

Been in the game since I was a teen and was stacking in high school during the Hunt Bros fiasco, about 45 years.

Silver has not kept up with inflation at least not in the last tens years…gold, barely if that. Money in a savings account earning .05% has more than beat average silver gains probably for the last decade, recent high premiums not helping one bit. Gold? It’s the same price today that I paid ten years ago, and I didn’t buy the high. Do I sound like a hater? I’m not, just really disappointed. I will use PM’s at least as a side savings account if everything else goes up in flames.

Buy both G&S, buy whatever catches your eye and saving a few bucks on a ounce here or there isn’t going to matter in the long run.

Been in the game since I was a teen and was stacking in high school during the Hunt Bros fiasco, about 45 years.

Silver has not kept up with inflation at least not in the last tens years…gold, barely if that. Money in a savings account earning .05% has more than beat average silver gains probably for the last decade, recent high premiums not helping one bit. Gold? It’s the same price today that I paid ten years ago, and I didn’t buy the high. Do I sound like a hater? I’m not, just really disappointed. I will use PM’s at least as a side savings account if everything else goes up in flames.

Buy both G&S, buy whatever catches your eye and saving a few bucks on a ounce here or there isn’t going to matter in the long run.

2,924 posts

·

Joined 2014

i agree. neither gold or silver is a bad move, so id have a little hoard of both. gold is easier to sell, but you ll always find a buyer for silver if you look. i'd sort of keep a bit as 'emergency money' when and where you can pick it up cheaply...meaning if there a large bill, dump some metal for some fast cash.You can take what I say with a grain of salt.

Been in the game since I was a teen and was stacking in high school during the Hunt Bros fiasco, about 45 years.

Silver has not kept up with inflation at least not in the last tens years…gold, barely if that. Money in a savings account earning .05% has more than beat average silver gains probably for the last decade, recent high premiums not helping one bit. Gold? It’s the same price today that I paid ten years ago, and I didn’t buy the high. Do I sound like a hater? I’m not, just really disappointed. I will use PM’s at least as a side savings account if everything else goes up in flames.

Buy both G&S, buy whatever catches your eye and saving a few bucks on a ounce here or there isn’t going to matter in the long run.

3,866 posts

·

Joined 2013

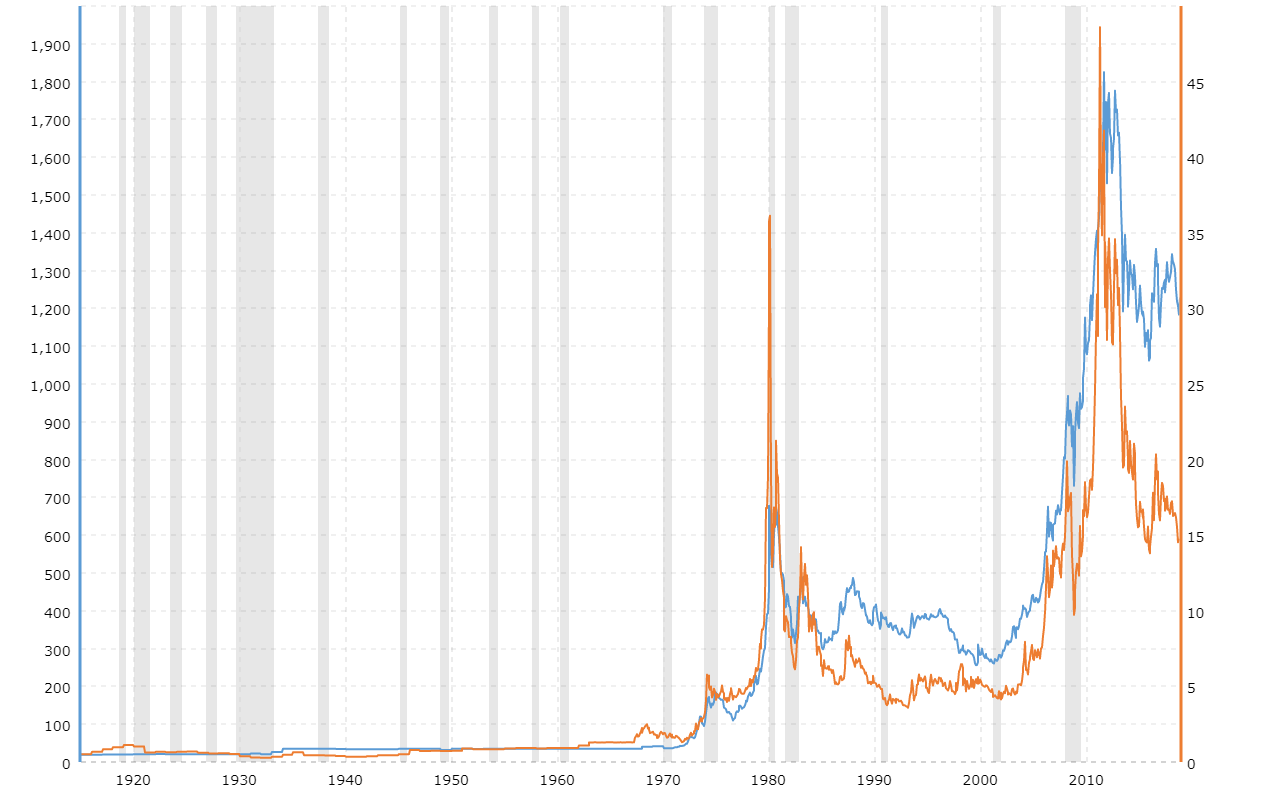

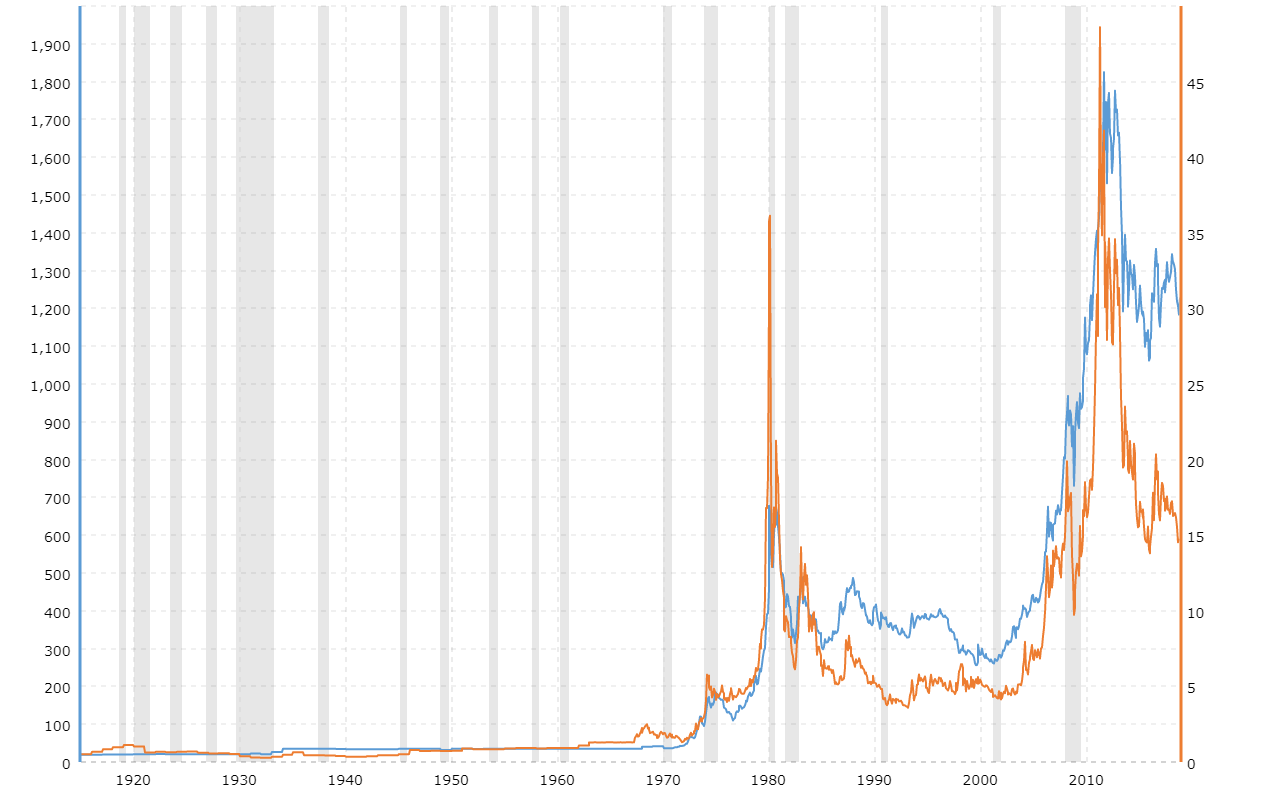

Why guess when you can look up the facts.

SP500 to Gold 10 year chart.

![Image]()

SP500 to Gold 10 year chart.

18,844 posts

·

Joined 2012

Stocks vs. Gold and Silver - Updated Chart | LongtermTrends

Which was the best investment in the past 30, 50, 80, or 100 years? This chart compares the performance of the S&P 500, the Dow Jones, Gold, and Silver. Including dividends leads to a very different picture.

7,185 posts

·

Joined 2009

My opinion is if that’s all your gonna be throwing to metals then go silver, if you plan to convert more fiat and savings then go gold

18,844 posts

·

Joined 2012

As you can see from the above chart which graphs the S&P500, DOW, gold, and silver for the last 10 years, Stocks have out performed both silver and gold. Gold has out performed silver.

I like others still prefer silver. Some are silver stackers a few are like me collect 90% silver US coins all dates and mint marks.

My method is more hobby driven. The stackers are more survivalist driven.

IMO it is easier to stack lots of silver taking advantage of dollar cost averaging. As for gold as you come across it keep it but it takes too long between buys at too high a cost to maintain the stacking discipline.

For all of the above reasons I would stack silver. Collecting for a hobby as I do will make it hard to barter with my silver and my cost vs. SHTF benefit will be high.

I like others still prefer silver. Some are silver stackers a few are like me collect 90% silver US coins all dates and mint marks.

My method is more hobby driven. The stackers are more survivalist driven.

IMO it is easier to stack lots of silver taking advantage of dollar cost averaging. As for gold as you come across it keep it but it takes too long between buys at too high a cost to maintain the stacking discipline.

For all of the above reasons I would stack silver. Collecting for a hobby as I do will make it hard to barter with my silver and my cost vs. SHTF benefit will be high.

25,560 posts

·

Joined 2008

If you are talking only enough to buy a single ounce you are better off buying barterable supplies. You can buy 4 pallets of canned goods for the price of an ounce of gold. No way does an ounce buy that much by spring.

1,206 posts

·

Joined 2011

Either one is a good prep but neither is an investment to me. I look at them as a hedge against inflation. I hope that their purchase power sometime down the road is the same as their purchase power today.

The only other thing I could ask or say is do you have enough food, water, protection, and other items before buying the silver and gold? I think PM is great but one of the last things to get.

The only other thing I could ask or say is do you have enough food, water, protection, and other items before buying the silver and gold? I think PM is great but one of the last things to get.

1,797 posts

·

Joined 2015

The 1999 - 2019 average gold/silver price ratio is 65:1, currently the gold/silver price ratio is 77.55:1. If the metals revert to their recent average price ratio, silver seems like the better buy for your dollar.

15,404 posts

·

Joined 2010

When things go south how will you exchange it?

I buy silver because I make colloidal silver, but I would not sell or trade it.

I buy silver because I make colloidal silver, but I would not sell or trade it.

25,560 posts

·

Joined 2008

Yes. To me the question is not "will Gold be worth more in dollars tomorrow than it was today", because you will have to spend dollars today in order to obtain the gold to begin with.When things go south how will you exchange it?

I buy silver because I make colloidal silver, but I would not sell or trade it.

The better question is this: whether dollars or gold, will they buy more goods tomorrow than they will today? The answer to that is probably no. Rising prices right now is not just due to money-printing, it is also due to a real lack of supply, and a dysfunctional supply chain, which affects the price of a can of beans, but not so much gold. Buy goods while you still can. Gold will still be there. But the shelves may be bare.

15,873 posts

·

Joined 2012

Personally I think the world has changed and PMs as a store of wealth are not as good of a bet as other commodities. Ancient people had little to invest in so picked PMs. Today, not so much. Younger generation cares little about PMs.

And a problem with PMs is you lose ~10% right off the top in paying over spot. So you take a 10% hit.

I have little interest in PMs unless I can get them favorably. I cannot eat them or use them for anything, and only trade them, assuming others want them. Not many do.

And a problem with PMs is you lose ~10% right off the top in paying over spot. So you take a 10% hit.

I have little interest in PMs unless I can get them favorably. I cannot eat them or use them for anything, and only trade them, assuming others want them. Not many do.

18,844 posts

·

Joined 2012

I agree. IMO one must look to what pleasure one get from having gold and silver.Personally I think the world has changed and PMs as a store of wealth are not as good of a bet as other commodities. Ancient people had little to invest in so picked PMs. Today, not so much. Younger generation cares little about PMs.

And a problem with PMs is you lose ~10% right off the top in paying over spot. So you take a 10% hit.

I have little interest in PMs unless I can get them favorably. I cannot eat them or use them for anything, and only trade them, assuming others want them. Not many do.

It is often said Bitcoin, etc. have replaced gold as a hedge. That may be so for the ones buying cyber currencies. The problem is they forgo any intrinsic value.

I cannot understand how something with zero intrinsic value can be a SHTF hedge.

1,206 posts

·

Joined 2011

Eighteen, that is how many post it takes to get to the center of a "you can't eat PM" tootsie roll pop!

12,550 posts

·

Joined 2015

If they reset the currency, PMs can theoretically be used to pay your taxes and debts after convertingit to the new currency. So PMs are a hedge against complete currency collapse and currency reset. When they change your life savings with a computer algorithm and austerity measures. Like the Greeks experienced.

I'd definitely buy PMs before holding a really large sum of paper money at home.

But like mentioned above, buying stuff is a good inflation hedge.

I'd definitely buy PMs before holding a really large sum of paper money at home.

But like mentioned above, buying stuff is a good inflation hedge.

7,185 posts

·

Joined 2009

Im kinda backed into a corner and have to buy PMs, I can’t buy the amount of preps I have in metals and I don’t want to hold that much in crypto, it’s all about wealth preservation for me and I really can’t think of anything better

basketweave

Discussion starter

970 posts

·

Joined 2011

All: Thanks for the great replies so far.

5,485 posts

·

Joined 2017

If you are comfortable in your other stores of wealth, AND out of debt, AND your other preparedness needs AND wants are filled.

Silver, given the amount in the question posed.

Silver, given the amount in the question posed.

5,809 posts

·

Joined 2017

If a person expects the gold:silver ratio to ever get back to normal that would suggest that gold should drop in price about 40% or silver should go up 80% so silver is what you should invest in long term.

But if you look at recent trends, gold it climbing much faster than silver so gold is what you should invest in.

But if you look at recent trends, gold it climbing much faster than silver so gold is what you should invest in.

3,866 posts

·

Joined 2013

What do you think is the normal price?If a person expects the gold:silver ratio to ever get back to normal that would suggest that gold should drop in price about 40% or silver should go up 80% so silver is what you should invest in long term.

But if you look at recent trends, gold it climbing much faster than silver so gold is what you should invest in.

In the last 30 years the GSR has had a low of 18 and a high of 126.

4,259 posts

·

Joined 2010

Both, but in the past silver at times has outperformed gold

In November 2001

gold was 283.

Silver 4.14

In April 2011 silver peaked at 38.31 925% increase

while gold peaked in august at 1,613 a 569% increase

Today gold is $1,779.45 or 628% increase from 2001

Silver is $24.06 or 579% increase

www.macrotrends.net

www.macrotrends.net

In November 2001

gold was 283.

Silver 4.14

In April 2011 silver peaked at 38.31 925% increase

while gold peaked in august at 1,613 a 569% increase

Today gold is $1,779.45 or 628% increase from 2001

Silver is $24.06 or 579% increase

Gold Prices vs Silver Prices Historical Chart

This chart compares gold prices and silver prices back to 1915. Each series shown is a nominal value to demonstrate the comparison in actual investment returns between each over various periods of time.

5,485 posts

·

Joined 2017

I respectfully disagree, simply based upon the OP amount of $ he stated he would spend.Both, but in the past silver at times has outperformed gold...

The equivalent of a single OZ of gold.

I would agree if the OP wanted to convert much larger sums of cash to PM's. Then yes, both. What % of gold vs silver would then depend upon the amount the OP wants to spend.

Higher % of gold, the more $ available to purchase. However & in my opinion, that shouldn't come into play IN TODAYS MARKET until roundabout $50,000 (ish). Either starting from zero, or prior holdings CURRENT value.

So, round about 80 tubes of .999 rounds. Which seems A LOT, however is still easily manageable in a home safe (or "should be" for most reasonably healthy folks). Then gold. As gold is far more "concentrated" portable value, hence easier to manage.

Again, just my opinion.

159 posts

·

Joined 2021

If you have the liquid cash for gold, always gold, but that's a lot of cash.

Most people don't have a savings large enough that gold is a viable option.

Most people don't have a savings large enough that gold is a viable option.

1,609 posts

·

Joined 2021

From This article...

"For the whole of the 20th century, the average gold-silver ratio was 47:1. In the 21st century, the ratio has ranged mainly between the levels of 50:1 and 70:1, breaking above that point in 2018 with a peak of 104.98:1 in 2020. The lowest level for the ratio was 40:1 in 2011."

This would say gold will probably give you a higher return. Having said that, I've heard that silver inventories are only a few months supply. If the climate change idiocy catches on, there will be increased production of solar panels, which requires silver. As electric car production ramps up, batteries will be more in demand. Just my opinion, but I think lithium-ion batteries are going to falll out of favor as we start to realize the ecological damage from mining and disposing of lithium. Silver-zinc or silver-oxide batteries could replace lithium-ion.

Personally, I've been buying silver over the last few months. Not a lot, about 25 ounces every 2 or 3 months. I like bullion coins. Stay away from the "collectibles". If the SHTF, melt value is all that will matter.

"For the whole of the 20th century, the average gold-silver ratio was 47:1. In the 21st century, the ratio has ranged mainly between the levels of 50:1 and 70:1, breaking above that point in 2018 with a peak of 104.98:1 in 2020. The lowest level for the ratio was 40:1 in 2011."

This would say gold will probably give you a higher return. Having said that, I've heard that silver inventories are only a few months supply. If the climate change idiocy catches on, there will be increased production of solar panels, which requires silver. As electric car production ramps up, batteries will be more in demand. Just my opinion, but I think lithium-ion batteries are going to falll out of favor as we start to realize the ecological damage from mining and disposing of lithium. Silver-zinc or silver-oxide batteries could replace lithium-ion.

Personally, I've been buying silver over the last few months. Not a lot, about 25 ounces every 2 or 3 months. I like bullion coins. Stay away from the "collectibles". If the SHTF, melt value is all that will matter.

4,259 posts

·

Joined 2010

I stopped buying when the price hit 9.00

Gold and silver can be used for many of the same purposes but silver is consumed, in a way not easily recoverable at a much higher rate than gold because of its lower price. It's used in engines Aloys electrical connections in cars and even more in electric cars, Solar panels, windows all kinds of stuff

Silver is often indirectly mined as a byproduct of mining for other metals like gold, lead, copper

Gold and silver can be used for many of the same purposes but silver is consumed, in a way not easily recoverable at a much higher rate than gold because of its lower price. It's used in engines Aloys electrical connections in cars and even more in electric cars, Solar panels, windows all kinds of stuff

Silver is often indirectly mined as a byproduct of mining for other metals like gold, lead, copper

5,947 posts

·

Joined 2010

Having purchased my first bullion in 2007 and every year since, with the benefit of hindsight and spreadsheets, I wish I would have skipped silver completely and bought only gold. The math (and storage requirements) favor gold heavily.

25,560 posts

·

Joined 2008

the problem about historical averages is that the industrial uses of gold and silver have shifted over time. like any commodity, demand will shift price, some of that demand is investment, some is numismatic, some is industrial. just keep that in mind.

basketweave

Discussion starter

970 posts

·

Joined 2011

From OP: Thanks all for the responses. Some really great people here on Survivalist Boards. I guess we're more wholesome than most 'net forums.

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

-

?

- posts

- 12M

- members

- 169K

- Since

- 2007

A forum community dedicated to survivalists and enthusiasts. Come join the discussion about collections, gear, DIY projects, hobbies, reviews, accessories, classifieds, and more!