Friends,

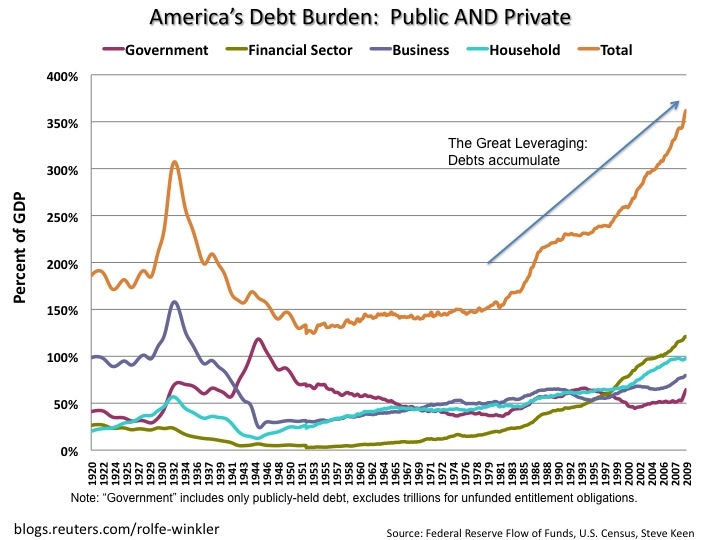

At this point in history I anticipate the greatest potential for some degree of societal collapse to be an economic collapse on a world-wide scale. Our national debt is north of $30 trillion, our unfunded federal liabilities are now north of $168 trillion, student debt is north of $1.7 trillion, the US federal debt (budget) is $2.3 trillion, the debt per tax payer in the US is $242,500. The Biden regime has absolutely no regard for spending constraints (neither did the Republicans before him), The US debt to GDP ratio is now at 125%, the interest now being paid on our federal debt is now more than $3.3 trillion, the US debt held by foreign countries (many of whom are our enemies) is $7.7 trillion. No one seems willing to even address these issues let alone do something to lessen the negative bad news.

Now this doesn't mean that other SHTF events couldn't also happen and, in fact, are likely to accompany an economic collapse. At this point even if there were the will to address these issues, I doubt that anything can be done to stop the day of reckoning that is headed our way. Your thoughts?

Source: https://usdebtclock.org

At this point in history I anticipate the greatest potential for some degree of societal collapse to be an economic collapse on a world-wide scale. Our national debt is north of $30 trillion, our unfunded federal liabilities are now north of $168 trillion, student debt is north of $1.7 trillion, the US federal debt (budget) is $2.3 trillion, the debt per tax payer in the US is $242,500. The Biden regime has absolutely no regard for spending constraints (neither did the Republicans before him), The US debt to GDP ratio is now at 125%, the interest now being paid on our federal debt is now more than $3.3 trillion, the US debt held by foreign countries (many of whom are our enemies) is $7.7 trillion. No one seems willing to even address these issues let alone do something to lessen the negative bad news.

Now this doesn't mean that other SHTF events couldn't also happen and, in fact, are likely to accompany an economic collapse. At this point even if there were the will to address these issues, I doubt that anything can be done to stop the day of reckoning that is headed our way. Your thoughts?

Source: https://usdebtclock.org